About Stripe

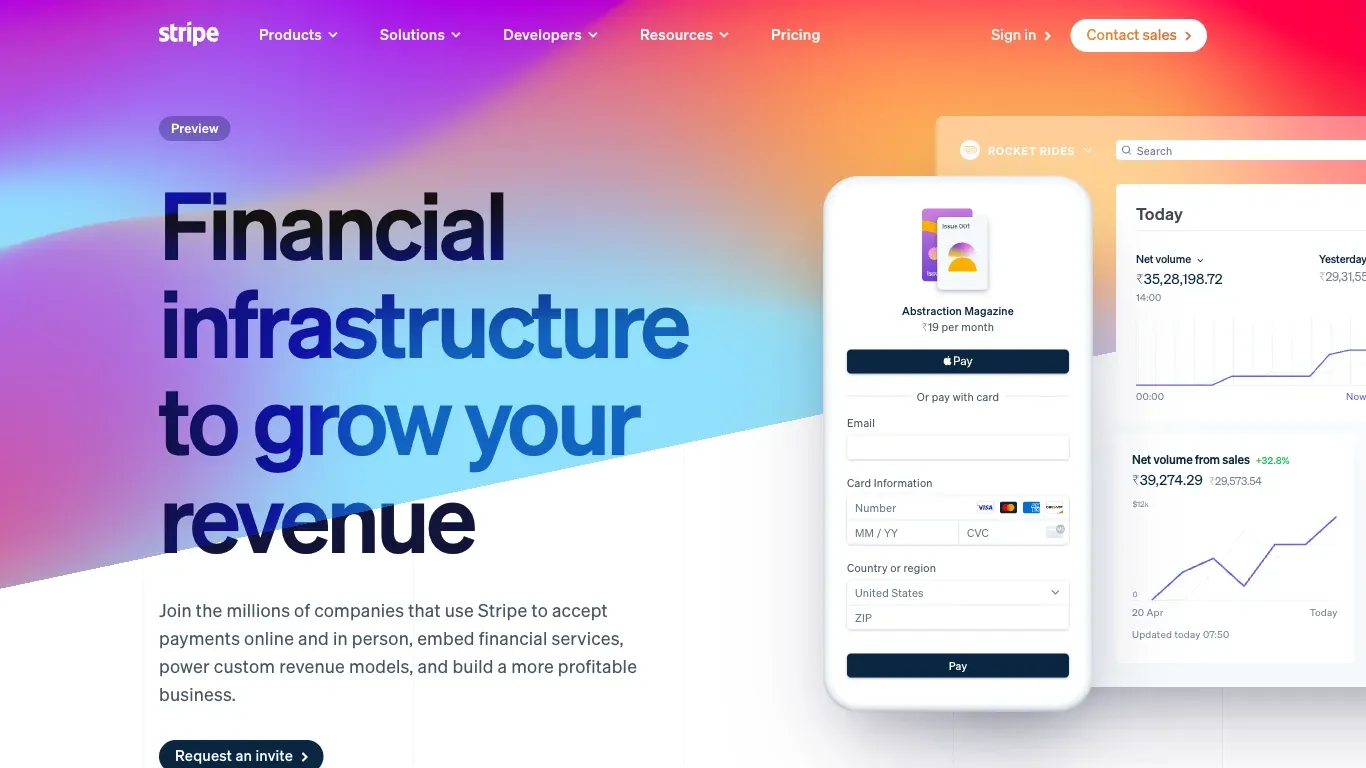

Stripe offers a robust financial infrastructure for businesses to handle online and in-person payments efficiently. It is designed for companies of all sizes looking to simplify transactions, embed financial services, and maximize revenue.

Key Features of Stripe

Stripe provides a comprehensive suite of payment processing tools that facilitate seamless transactions. Its platform supports a variety of payment methods, including credit cards and popular digital wallets like Apple Pay. Stripe's advanced analytics offer real-time insights into transaction patterns and sales growth, empowering businesses with data-driven decision-making.

Moreover, Stripe has flexible integration capabilities, allowing developers to seamlessly embed its services within existing business applications. It also offers tailored solutions for industries like retail, SaaS, and marketplaces, ensuring that diverse business needs are met effectively.

Use Cases of Stripe

Stripe is ideal for e-commerce platforms that need to offer diverse payment options to their customers globally. It is equally beneficial for subscription-based businesses seeking reliable recurring billing solutions. SaaS companies benefit from Stripe's ability to integrate seamlessly with software applications, enhancing user experience and revenue efficiency.

Additionally, large enterprises and startups alike can leverage Stripe’s customizability to build fully integrated finance services, enabling scalable financial operations and a more profitable business model.